Top Investment Tips and Strategies for Financial Success

Whether you're new to investing or looking to refine your approach, understanding key strategies and financial products can help you build a secure financial future. This article covers some essential investment tips, share market advice, futures trading strategies, and more to help you make informed decisions with confidence.

Related searches

-

Fisher Investments 99 Retirement Tips

-

Futures Trading Strategies

-

Investment Tips

-

Inflation Protected Bonds

-

Real Investment Advice

-

Share Market Tips

Investment Tips for Beginners and Experienced Investors

Starting an investment journey can be overwhelming, but following some tried-and-true investment tips can set you on the right path. Diversifying your portfolio, setting clear financial goals, and understanding your risk tolerance are essential steps. Whether you’re investing in stocks, bonds, or mutual funds, having a well-rounded portfolio helps protect against market volatility and maximizes your potential for long-term growth.

Share Market Tips: Navigating Stock Investments

For those interested in the share market, there are specific strategies to enhance your returns. Monitoring market trends, staying informed about economic events, and conducting regular analysis of stocks you’re interested in are critical. Share market tips include keeping an eye on blue-chip stocks, considering dividend-yielding shares for regular income, and practicing patience as stocks appreciate in value over time.

Futures Trading Strategies: Planning for Short- and Long-Term Gains

Futures trading can be a powerful tool for investors looking to make both short- and long-term gains. Futures trading strategies often include hedging to protect against price fluctuations, utilizing leverage to maximize returns, and practicing disciplined stop-loss techniques to manage risk. This form of trading requires knowledge and caution but can be profitable for those who approach it with a solid plan and strategy.

Inflation Protected Bonds: A Safe Investment During Economic Uncertainty

With inflation concerns on the rise, many investors are turning to inflation-protected bonds, which offer a safeguard against rising prices. These bonds are tied to inflation rates, so their returns increase as inflation does, helping protect your purchasing power. Inflation-protected bonds are ideal for conservative investors or those seeking a more stable investment with a guaranteed return.

Fisher Investments 99 Retirement Tips: Preparing for a Comfortable Future

Planning for retirement is crucial, and Fisher Investments’ 99 retirement tips provide valuable guidance for those looking to build a secure retirement fund. These tips cover everything from budgeting and maximizing retirement account contributions to tax-efficient investment strategies. Following such comprehensive advice can help ensure that you have the funds you need for a comfortable and worry-free retirement.

Real Investment Advice: Making Informed Financial Decisions

Getting real investment advice from trusted sources is key to building a successful portfolio. Consulting with financial advisors, researching investment products thoroughly, and avoiding get-rich-quick schemes are all essential steps. Real investment advice centers around making well-informed, strategic decisions that align with your long-term financial goals rather than short-term market trends.

By understanding these key investment concepts, from share market tips to futures trading strategies, you can enhance your financial planning efforts and work towards a secure financial future. With the right knowledge and careful planning, you can make investment choices that yield positive results and help you achieve your financial goals.

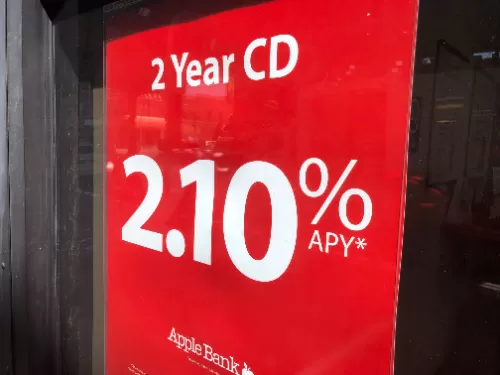

Navigating the Terrain of CD Rates: A Guide to Maximizing Your Savings

In the realm of personal finance, Certificate of Deposit (CD) rates play a pivotal role in helping individuals grow their savings. Whether you're a seasoned investor or a newcomer to the world of financial planning, understanding CD rates is essential for making informed decisions about your money.

Unlocking Opportunities: How to Secure Small Business Grants in the USA

Starting or growing a small business in the USA can be challenging, but grants provide a valuable lifeline. Whether you're looking to expand, launch a startup, or recover from financial setbacks, small business grants can give you the boost you need without adding debt to your bottom line. This guide will help you navigate the process of applying for these grants and maximizing your chances of success.

Navigating Debt: Effective Solutions to Improve Your Financial Health

Managing debt can be overwhelming, but there are various ways to get help and improve your financial situation. From understanding the impact of paying a debt collector to finding free debt consolidation services, this guide provides valuable information to help you take control of your finances.

Choosing the Right Financial Advisor for Your Future: A Guide for Older Americans

As you approach retirement or navigate your later years, making informed financial decisions is more important than ever. A financial advisor can help you plan for the future, manage your wealth, and ensure that you’re on track to meet your financial goals. For many older Americans, seeking unbiased financial advice from top wealth management advisors is the key to securing their financial future. In this article, we will explore how to choose the best financial advisor for your needs and the advantages of working with top independent wealth management firms.

Top 10 HELOC Lenders for 2025

As you own your home longer, pay down your mortgage, and make home improvements, you build equity. Just as your home was used as collateral for your original mortgage, that same equity can serve as collateral for future loans, known as HELOCs (Home Equity Lines of Credit).

Maximize Your Savings: Discover the Best High Interest Accounts and Safe Investment Options

Are you looking for ways to grow your savings while minimizing risks? Whether you're searching for the best savings accounts or safe places to invest your money, this guide will help you navigate the top options available today.

By:

Laura

By:

Laura