Navigating the Terrain of CD Rates: A Guide to Maximizing Your Savings

In the realm of personal finance, Certificate of Deposit (CD) rates play a pivotal role in helping individuals grow their savings. Whether you're a seasoned investor or a newcomer to the world of financial planning, understanding CD rates is essential for making informed decisions about your money.

Related searches

-

American Express Cd Rates

-

Wells Fargo Cd Rates 2024

-

Bmo Harris Cd Rates

-

Huntington Cd Rates

-

Wells Fargo Cd Rates

-

Discover Bank Cd Rates

Understanding CD Rates: The Basics

At its core, a Certificate of Deposit is a time-bound savings account that offers higher interest rates compared to traditional savings accounts. CD rates, determined by financial institutions, dictate the amount of interest you'll earn on your investment over a specific period, typically ranging from a few months to several years.

Comparing Rates: Finding the Best Deal

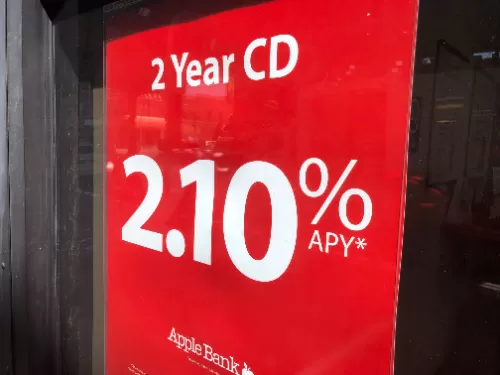

When exploring CD options, comparing rates is paramount. Different banks and credit unions offer varying rates based on factors such as market conditions, deposit amount, and term length. By researching and comparing rates from multiple institutions, you can identify the most competitive offers and maximize your earning potential.

Factors Influencing CD Rates

Several factors influence CD rates, including economic indicators, inflation rates, and central bank policies. In times of economic stability and low inflation, CD rates tend to be lower. Conversely, during periods of economic uncertainty or rising inflation, CD rates may increase to attract investors seeking safer investment options.

Strategies for Maximizing Returns

To capitalize on CD rates, consider employing strategic savings techniques. For instance, "laddering" involves dividing your investment across multiple CDs with staggered maturity dates. This strategy allows you to access funds periodically while taking advantage of potentially higher rates on longer-term CDs.

Navigating Rate Fluctuations

CD rates are subject to fluctuations based on market dynamics and economic trends. While locking in a favorable rate can provide stability and peace of mind, it's essential to remain flexible and adapt to changing conditions. Monitoring interest rate movements and staying informed about economic developments can help you make informed decisions about your CD investments.

Harnessing the Power of CD Rates

In the realm of personal finance, CD rates serve as a cornerstone of wealth-building strategies. By understanding how CD rates work, comparing offers, and employing savvy savings techniques, individuals can harness the power of CD investments to achieve their financial goals. Whether you're saving for a short-term objective or planning for long-term growth, navigating the terrain of CD rates is key to optimizing your savings journey.

Unlock Your Potential: Apply for Government Small Business Grants Today

Starting or expanding a small business can be a challenging journey, but government small business grants offer an incredible opportunity to fuel your dreams. These grants provide a financial boost without the burden of repayment, allowing you to focus on growing your business. In this guide, we’ll explore various options and how you can secure the funding you need.

Maximize Your Brand Impact at Trade Shows with the Perfect Booth and Display Solutions

In the ever-evolving world of business, trade shows remain one of the most effective ways to network, engage potential clients, and showcase your brand. Whether you're exhibiting at a local event or a national trade show, having an impressive trade show booth is essential for standing out among the competition. As we move into 2024, here's a look at how you can elevate your trade show presence with the right trade show backdrop, pop-up displays, banners, and more—plus some tips on how current trends can make your booth even more impactful.

The Best Business Loan Options to Grow Your Small Business

Running a business requires capital, and securing the right funding can make all the difference in growth and stability. Whether you're looking for small business loans, fast business loans, or long-term financing, understanding your options is crucial. Here’s a breakdown of the best business loan choices available in the U.S.

Best Tax Filing Services: File Your Taxes Fast & Maximize Your Refund

Tax season is here, and finding the best tax filing service can make all the difference. Whether you’re looking for a quick and easy way to file or need expert assistance to maximize your refund, choosing the right service is essential. Here’s a breakdown of the top-rated tax filing services in 2024 that can help you file with confidence.

Maximize Your Brand Impact at Trade Shows with the Perfect Booth and Display Solutions

In the ever-evolving world of business, trade shows remain one of the most effective ways to network, engage potential clients, and showcase your brand. Whether you're exhibiting at a local event or a national trade show, having an impressive trade show booth is essential for standing out among the competition. As we move into 2024, here's a look at how you can elevate your trade show presence with the right trade show backdrop, pop-up displays, banners, and more—plus some tips on how current trends can make your booth even more impactful.

Get cash support instantly,apply for cash loan to tackle emergencies

In modern life, there is often a need for immediate cash support, and cash loans provide a quick, convenient, and reliable solution. The application process is simple, and approval is efficient. The loan amount and term are flexible, ensuring customer privacy and security. It helps address emergencies, navigate financial challenges, and achieve personal and family goals.

By:

amanda

By:

amanda