Understanding Vehicle Insurance: A Comprehensive Guide

Vehicle insurance is an essential aspect of owning and operating a vehicle. It provides financial protection against accidents, theft, and other unforeseen events that could lead to significant expenses.

Related searches

-

Car And House Insurance

-

Homeowners Car Insurance

-

Car Insurance Quotation Online

-

Automotive Insurance Quote

-

Affordable Full Coverage Car Insurance

-

Shop For Car Insurance

This article will explore the key components of vehicle insurance, its importance, and how to choose the right policy.

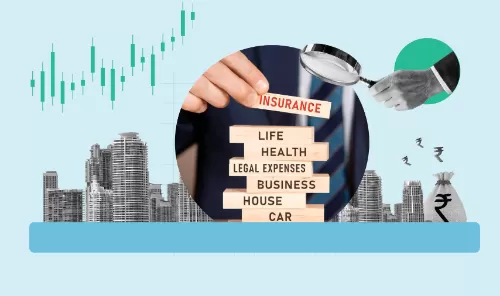

What is Vehicle Insurance?

Vehicle insurance, also known as auto insurance, is a contract between the vehicle owner and an insurance company. The owner pays a premium, and in return, the insurance company agrees to cover certain financial losses resulting from accidents, theft, or damage to the vehicle. The extent of coverage depends on the type of policy chosen.

Types of Vehicle Insurance Coverage

There are several types of vehicle insurance coverage, each offering different levels of protection:

Liability Insurance: This is the most basic form of coverage and is usually mandatory in most countries. It covers the costs associated with injuries or damage to other people or their property caused by the insured vehicle. However, it does not cover the damage to the insured's own vehicle.

Collision Insurance: This type of insurance covers the cost of repairing or replacing the insured vehicle if it is damaged in a collision with another vehicle or object, regardless of who is at fault.

Comprehensive Insurance: Comprehensive insurance covers damage to the insured vehicle caused by events other than collisions, such as theft, vandalism, natural disasters, or hitting an animal. This type of coverage is usually optional but provides broader protection.

Personal Injury Protection (PIP): PIP covers medical expenses and, in some cases, lost wages for the driver and passengers of the insured vehicle, regardless of who is at fault in an accident.

Uninsured/Underinsured Motorist Coverage: This coverage protects the insured if they are involved in an accident with a driver who has no insurance or insufficient insurance to cover the damages.

Why is Vehicle Insurance Important?

Vehicle insurance is crucial for several reasons:

Legal Requirement: In most places, having at least liability insurance is required by law. Driving without insurance can lead to fines, license suspension, or even imprisonment.

Financial Protection: Accidents can result in significant financial losses, including vehicle repair costs, medical bills, and legal fees. Insurance helps mitigate these expenses.

Peace of Mind: Knowing that you are financially protected in case of an accident or theft allows you to drive with confidence and peace of mind.

How to Choose the Right Vehicle Insurance

Choosing the right vehicle insurance can be challenging, but considering the following factors can help:

Coverage Needs: Assess your needs based on your vehicle's value, driving habits, and risk factors. If you drive frequently or own a high-value vehicle, comprehensive coverage might be a wise choice.

Budget: Determine how much you can afford to pay for premiums. While it's tempting to choose the cheapest option, remember that lower premiums often mean less coverage.

Deductibles: A higher deductible can lower your premium, but it also means you’ll pay more out of pocket in case of a claim. Choose a deductible that balances your financial situation and risk tolerance.

Insurance Provider: Research different insurance companies, read reviews, and check their customer service ratings. A reliable provider with good customer service can make a significant difference when filing a claim.

Discounts: Many insurance companies offer discounts for safe driving, bundling policies, or installing anti-theft devices in your vehicle. Be sure to inquire about any available discounts to reduce your premium.

Conclusion

Vehicle insurance is more than just a legal requirement; it is a vital safeguard for your financial well-being. By understanding the different types of coverage and considering your specific needs and budget, you can choose the right policy that offers the protection you need. Always remember to review your insurance policy regularly to ensure it continues to meet your needs as they change over time.

Essential Business Insurance for Small Businesses and Startups

As a business owner, protecting your company from potential risks is crucial. Whether you're a startup or an established small business, having the right insurance coverage can save you from significant financial losses. Below, we explore the most important types of business insurance you should consider.

Understanding Medicare Insurance: Navigating Coverage in Todays World

As the landscape of healthcare continues to evolve, understanding Medicare insurance is crucial for seniors and their families. Medicare provides essential health coverage for millions of Americans aged 65 and older, but many are unaware of the options available to them or the changes that have occurred recently.

Understanding Health Insurance: What You Need to Know in 2025

Health insurance is a critical safety net for protecting your well-being and financial security. As 2025 unfolds, there are a few key changes in health insurance policies that every American should be aware of to ensure they make the best choices for themselves and their families.

Finding the Best Motorcycle Insurance for Your Needs

Choosing the right motorcycle insurance can be challenging with so many options available. Whether you’re looking for affordable coverage or a specific provider, it’s important to understand what to look for. Here’s a guide to help you find the best motorcycle insurance for your needs.

Vehicle Insurance Discounts: Unlocking Savings for Drivers

Finding affordable vehicle insurance can significantly impact your overall financial health. Many insurance companies offer various discounts that can help reduce your premiums. Here’s a look at some common vehicle insurance discounts available today, along with tips on how to take advantage of them.

Insurance Companies: Understanding Their Role and How to Choose the Right One

Insurance companies play a crucial role in managing risk and providing financial protection against various uncertainties.

By:

Ada

By:

Ada